The Trading Strategy Reality Check: Why SPY is Your Ultimate Benchmark

When I want to test trading strategies, I face a fundamental problem: how do I know if a strategy is actually worth my time and money? How do I know if it's any good?

I believe a simple benchmark against the market is the best measure. If I'm going to spend my time trading, backtesting, and stressing about outcomes, maybe even considering doing this full time, then my strategy should beat the returns that anyone can achieve with a simple invest-and-forget approach.

A strategy is only worth exploring if it beats holding SPY and doing nothing.

The Benchmark That Humbles Every Strategy

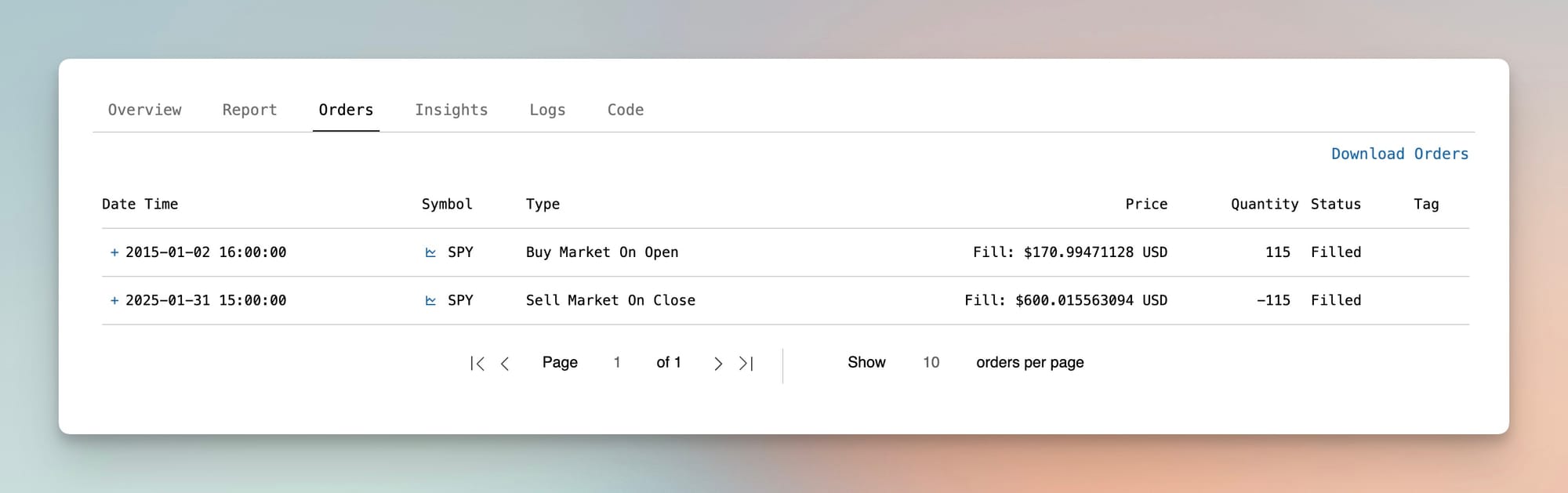

- Asset: S&P 500

- Strategy: Buy on day one, hold until the end, sell on final day

- Period: January 2015 to January 2025

- No rebalancing, no adjustments, no clever timing

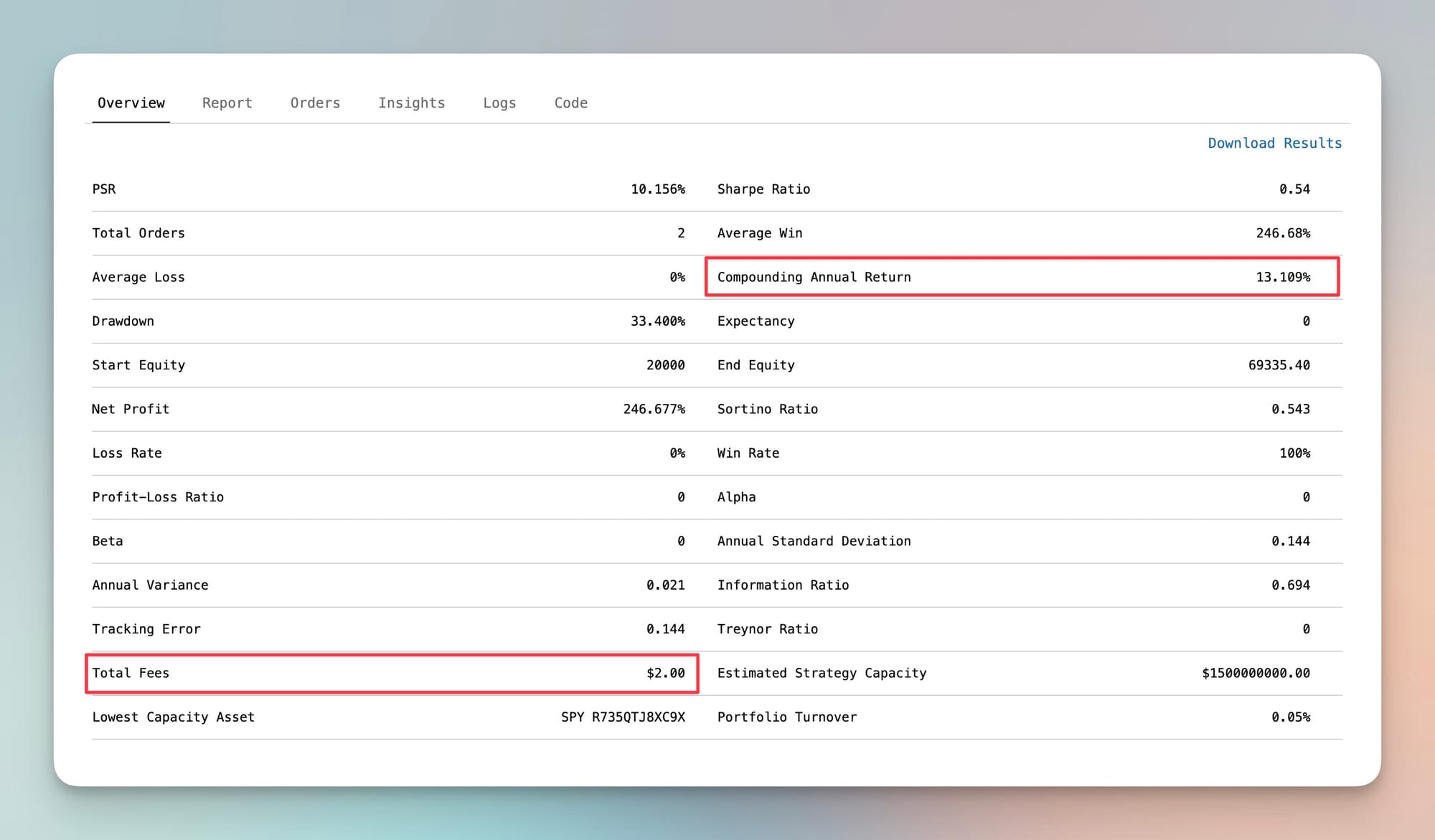

Key Results

- Total Return: 246.68%

- Compounding Annual Return: 13.1%

- Sharpe Ratio: 0.54

- Maximum Drawdown: -33.4% (March 2020)

Why This Benchmark Destroys Complex Alternatives

I've seen traders create sophisticated benchmark systems that adjust for volatility, sector rotation, and market conditions. These approaches have a fatal flaw: they make strategy evaluation subjective and inconsistent. Consider the following common benchmark mistakes:

Risk-Parity Adjustments: Who decides the "appropriate" risk level? Different traders have different risk tolerances, making my comparisons meaningless.

Volatility Matching: This assumes my strategy should match market volatility, but what if my edge comes from different volatility exposure?

Multiple Allocation Levels: Testing at 10%, 25%, and 50% allocation creates three different benchmarks for the same strategy.

Sector-Specific Benchmarks: If I'm trading forex or crypto, why benchmark against technology stocks?

The SPY benchmark eliminates these problems. It's universal, objective, and brutally honest.

Now I can't wait to see how many popular trading strategies fail to beat this simple benchmark. Will technical indicator combinations hold up? What about those "proven" YouTube trading systems and forex strategies? And cryptocurrency trading bots? 😎

Most traders won't like the answer.

Why This Matters

Before I risk real money on any strategy, I ask one simple question: Does this beat 13.1% annual returns?

If the answer is no, I'm better off buying SPY and focusing on my day job. If the answer is yes, I need to understand why the strategy works and whether that edge will persist.

This simple framework will save me from wasting time on strategies that can't beat basic market returns.

Complementary materials

Code used for this benchmark:

# region imports

from AlgorithmImports import *

# endregion

class SpyBenchmark(QCAlgorithm):

def initialize(self):

# Backtest period

self.set_start_date(2015, 1, 1)

self.set_end_date(2025, 1, 31)

# Portfolio setup

self.starting_cash = 20000

self.set_cash(self.starting_cash)

self.set_brokerage_model(BrokerageName.INTERACTIVE_BROKERS_BROKERAGE, AccountType.MARGIN)

# Add SPY equity

self.spy = self.add_equity("SPY", Resolution.DAILY).symbol

# Track initial purchase

self.initial_purchase_made = False

# Schedule end-of-backtest liquidation

self.schedule.on(self.date_rules.on(self.end_date.year, self.end_date.month, self.end_date.day),

self.time_rules.at(15, 0),

self.place_moc_liquidation)

def place_moc_liquidation(self):

"""Liquidate position at market close on final day"""

if self.portfolio[self.spy].invested:

quantity = self.portfolio[self.spy].quantity

self.market_on_close_order(self.spy, -quantity)

self.log(f"MOC liquidation order: {quantity} shares")

def on_data(self, data: Slice):

"""SPY benchmark - purchase SPY once and hold"""

# Check data availability

if not data.contains_key(self.spy):

return

# Execute single purchase at start

if not self.initial_purchase_made:

self.set_holdings(self.spy, 1)

self.log(f"Buy & Hold - Purchased SPY at {self.time}")

self.initial_purchase_made = True

Backtest report

Educational Disclaimer: Everything on Backtest Arena is for educational purposes only. I'm not your financial advisor, and this isn't investment advice. I'm here to show you what doesn't work in trading, not to tell you what to buy or sell. All backtest results use historical data - markets change, and past performance means nothing for future results. Trading is risky and most people lose money. Do your own research and consult a qualified professional before risking real capital.