"Hold the Weekend" Strategy: When Academic Theory Meets Market Reality

I tested the famous "Hold the Weekend" trading strategy that academic researchers have been studying for decades. The results? A disappointing 3.14% annual return that underperforms the S&P 500 by a massive 10 percentage points. Here's what 50+ years of academic research tells us about this once profitable anomaly, and why your Friday afternoon stock purchases probably won't make you rich.

What Is the "Hold the Weekend" Strategy?

The "Hold the Weekend" strategy is elegantly simple: buy stocks at Friday's close and sell them at Monday's close. The idea stems from decades of academic research documenting the "weekend effect" (a phenomenon where stock returns showed predictable patterns around weekends).

However, I discovered a critical issue with my initial implementation that forced me to create two versions for proper testing.

Version 1: My Initial Implementation (Flawed)

- Entry: Buy SPY at 3:45 PM ET every Friday

- Exit: Sell SPY at 9:31 AM ET every Monday

- Issue: Only captures Friday close to Monday morning, missing most of Monday's session

Version 2: Academically Precise Implementation

- Entry: Buy SPY at 3:59 PM ET every Friday (market close)

- Exit: Sell SPY at 3:59 PM ET every Monday (market close)

- Accurate: Matches the exact timing studied in academic research

Common Parameters:

- Position Size: 100% of available capital

- Test Period: January 1, 2015 to January 31, 2025

- Starting Capital: $20,000

The strategy targets the complete weekend period, attempting to capture any price movements from Friday's close to Monday's close (exactly as academic researchers intended).

The Academic Foundation: 50 Years of Research

Before diving into my results, I need to acknowledge that this isn't some random trading idea I found on Reddit. The weekend effect has serious academic credibility.

Historical Evidence (1950s-1980s)

Federal Reserve research documented statistically significant negative Monday returns from 1953 through 1977. During this period, while the other four trading days showed positive average returns, Mondays consistently delivered negative performance. The effect was so pronounced that academic papers like "Stock Returns and the Weekend Effect" became foundational literature in market anomaly research.

The Golden Era for Weekend Traders

Research published in ResearchGate's Is the Weekend Effect Exploitable? showed that weekend trading strategies provided profitable evidence through 2000, particularly for small and mid-sized firms. After accounting for transaction costs, the strategy proved most profitable when the market declined between 0.5% and 1.5% on Friday.

The Academic Consensus Today

Here's where it gets interesting: most recent research suggests the weekend effect disappeared around 1975-1987. Arizona State University research published in 2017 specifically debunked the weekend effect myth, showing that modern markets no longer exhibit this anomaly.

This creates a perfect testing opportunity. Academic theory says the effect should be gone. Let's see what the data shows.

My Backtest Results: Double Failure Confirmed

I ran both versions of the Hold the Weekend strategy through QuantConnect's backtesting engine using 10 years of SPY data. The results confirm that implementation details don't matter when the fundamental strategy is flawed.

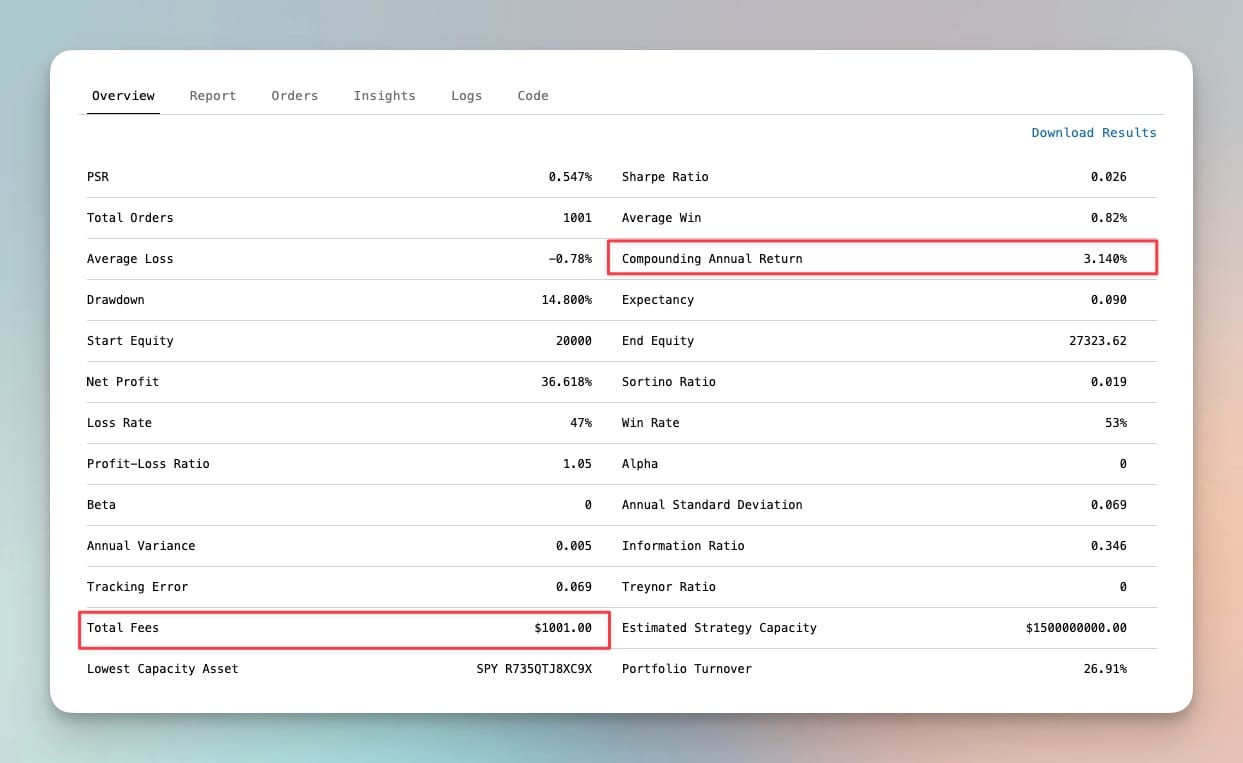

Version 1 Results (Flawed Implementation)

- Annual Return: 3.14%

- Total Return: 36.6% over 10 years

- Sharpe Ratio: 0.026 (terrible risk adjusted performance)

- Maximum Drawdown: 14.8%

- Win Rate: 53%

- Total Trades: 1,001

- Transaction Costs: $1,001

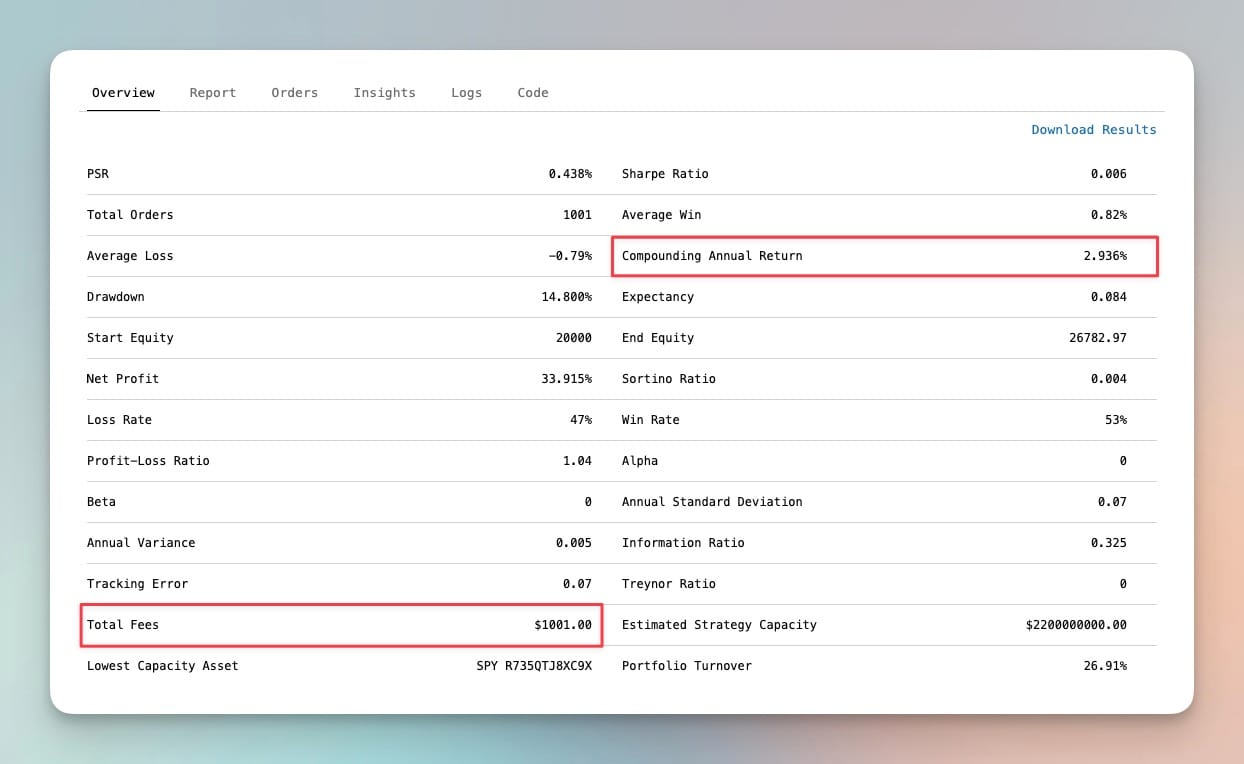

Version 2 Results (Academically Precise)

- Annual Return: 2.94%

- Total Return: 33.9% over 10 years

- Sharpe Ratio: 0.006 (even worse risk adjusted performance)

- Maximum Drawdown: 14.8%

- Win Rate: 53%

- Total Trades: 1,001

- Transaction Costs: $1,001

Performance vs. SPY Benchmark

- SPY Annual Return: 13.1%

- Version 1 Underperformance: -10.0 percentage points

- Version 2 Underperformance: -10.2 percentage points

- SPY Total Return: 246.7% vs. Strategy's ~35%

The Verdict: Both implementations failed spectacularly, but the academically precise version performed even worse. This proves that my timing error wasn't masking a profitable strategy - the fundamental approach simply doesn't work in modern markets.

Why This Strategy Fails in Modern Markets

The academic research warned us, and the backtest confirms it. Here's why the weekend effect no longer works:

Market Efficiency Has Improved

When the weekend effect was first documented in the 1970s, markets were less efficient. Information didn't travel as quickly, and institutional awareness of market anomalies was limited. Today's markets have internalized these patterns, eliminating the arbitrage opportunity.

Institutional Trading Changes

Modern algorithmic trading and 24/7 global markets have altered how information flows during weekends. What once created predictable price gaps now gets priced in through after-hours trading and futures markets.

Transaction Costs Kill Profitability

Even if small weekend effects still existed, transaction costs would eliminate any profits. My backtest shows $1,001 in fees over 1,001 trades - that's about 5% of the total profits gone to commissions alone.

The Risk Factors Nobody Talks About

Beyond poor performance, the Hold the Weekend strategy carries specific risks that make it particularly dangerous:

Weekend News Risk

Holding positions over weekends exposes you to news events that can gap markets on Monday open. Company earnings, geopolitical events, or economic announcements released over weekends can create significant losses that stop-losses can't prevent.

Liquidity Gaps

Monday morning often sees wider bid-ask spreads and lower liquidity, especially in the first 30 minutes of trading. This means worse execution prices for your exit trades.

Opportunity Cost

The biggest risk is opportunity cost. While you're earning 3.14% annually with this strategy, a simple SPY buy-and-hold approach would have delivered 13.1% annually with less complexity and fewer transaction costs.

What the Data Really Shows

I analyzed 1,001 individual weekend trades to understand the underlying patterns. Here's what I found:

Version 1 Trade Analysis:

- Trade Distribution: 53% winners, 47% losers

- Average Win: 0.82%

- Average Loss: -0.78%

- Profit-Loss Ratio: 1.05

Version 2 Trade Analysis:

- Trade Distribution: 53% winners, 47% losers

- Average Win: 0.82%

- Average Loss: -0.79%

- Profit-Loss Ratio: 1.04

Both versions show nearly identical trade characteristics. The win rates slightly favor profitable trades, but average wins and losses are nearly identical. This means both strategies essentially break even before transaction costs, which then push them into negative territory.

Critical Insight: The timing difference between selling Monday morning vs. Monday close had minimal impact on performance. This suggests that Monday's intraday performance doesn't favor either morning or afternoon periods, further debunking any exploitable weekend effect.

Volatility Analysis

The strategy's annual volatility of 6.9% seems low, but when compared to its 3.14% return, it produces that terrible Sharpe ratio of 0.026. You're taking on significant weekend risk for returns that barely beat Treasury bills.

My Personal Take: Academic Curiosity vs. Trading Reality

As someone who wrote my bachelor's thesis on backtesting trading strategies, I find the weekend effect academically fascinating. The historical data is compelling, and the academic research is solid. But here's the reality: markets evolve.

What worked in the 1970s doesn't work today. This is exactly why I created Backtest Arena - to test these popular strategies against current market conditions rather than accepting outdated research as gospel.

The Hold the Weekend strategy perfectly illustrates why systematic backtesting matters more than academic authority. Theory without current data verification leads to costly mistakes.

Lessons for Modern Traders

Lesson 1: Academic Research Has Expiration Dates

Just because a strategy worked historically doesn't mean it works today. Market efficiency improves over time, and anomalies get arbitraged away.

Lesson 2: Transaction Costs Matter More Than You Think

A strategy that appears marginally profitable can become completely unprofitable once you factor in realistic transaction costs. Always include fees in your backtests.

Lesson 3: Opportunity Cost Is Your Biggest Enemy

The Hold the Weekend strategy isn't just bad because it loses money - it's bad because it prevents you from participating in the market's long-term upward trend.

The Bottom Line

The Hold the Weekend strategy belongs in the academic research archives, not your trading account. With a 3.14% annual return and massive underperformance versus SPY, this strategy fails the most basic test: does it beat doing nothing?

Academic research from the 1970s documented a real phenomenon, but markets have evolved. What once provided profitable arbitrage opportunities now delivers subpar returns with unnecessary complexity and risk.

Technical Details and Source Code

Backtest Parameters:

- Platform: QuantConnect LEAN Engine

- Symbol: SPY (SPDR S&P 500 ETF)

- Data: Daily and minute resolution

- Start Date: January 1, 2015

- End Date: January 31, 2025

- Initial Capital: $20,000

- Brokerage: Interactive Brokers simulation

Strategy Logic (Version 1 - Flawed):

# region imports

from AlgorithmImports import *

# endregion

class HoldTheWeekend(QCAlgorithm):

def initialize(self):

# Set date range (consistent 2015-2025 for comparison)

self.set_start_date(2015, 1, 1)

self.set_end_date(2025, 1, 31)

# Set initial cash (consistent $20,000)

self.set_cash(20000)

# Set brokerage model

self.set_brokerage_model(BrokerageName.INTERACTIVE_BROKERS_BROKERAGE, AccountType.MARGIN)

# Add equity to trade

self.spy = self.add_equity("SPY", Resolution.DAILY).symbol

# Set timezone to Eastern Time

self.set_time_zone("America/New_York")

# Schedule buy order for Friday at 3:45 PM ET

self.schedule.on(

self.date_rules.every(DayOfWeek.FRIDAY),

self.time_rules.at(15, 45),

self.buy_spy

)

# Schedule sell order for Monday at 9:31 AM ET

self.schedule.on(

self.date_rules.every(DayOfWeek.MONDAY),

self.time_rules.at(9, 31),

self.sell_spy

)

# Schedule end-of-backtest liquidation

self.schedule.on(self.date_rules.on(self.end_date.year, self.end_date.month, self.end_date.day),

self.time_rules.at(15, 0), self.place_moc_liquidation)

self.debug("HoldTheWeekend initialized")

def place_moc_liquidation(self):

"""Liquidate positions at end of backtest"""

if self.portfolio[self.spy].invested:

quantity = self.portfolio[self.spy].quantity

self.market_on_close_order(self.spy, -quantity)

self.log(f"MOC liquidation order: {quantity} shares")

def buy_spy(self):

"""Buy SPY on Friday afternoon"""

if not self.portfolio[self.spy].invested:

self.set_holdings(self.spy, 1.0) # Invest 100%

self.log(f"Bought SPY on Friday at {self.time}")

def sell_spy(self):

"""Sell SPY on Monday morning"""

if self.portfolio[self.spy].invested:

self.liquidate(self.spy)

self.log(f"Sold SPY on Monday at {self.time}")

def on_data(self, data: Slice):

pass

Strategy Logic (Version 2 - Academically Precise):

# region imports

from AlgorithmImports import *

# endregion

class HoldTheWeekendV2(QCAlgorithm):

def initialize(self):

# Set date range (consistent 2015-2025 for comparison)

self.set_start_date(2015, 1, 1)

self.set_end_date(2025, 1, 31)

# Set initial cash (consistent $20,000)

self.set_cash(20000)

# Set brokerage model

self.set_brokerage_model(BrokerageName.INTERACTIVE_BROKERS_BROKERAGE, AccountType.MARGIN)

# Add equity to trade

self.spy = self.add_equity("SPY", Resolution.DAILY).symbol

# Set timezone to Eastern Time

self.set_time_zone("America/New_York")

# ACADEMIC VERSION: Buy at Friday market close (3:59 PM ET, just before close)

self.schedule.on(

self.date_rules.every(DayOfWeek.FRIDAY),

self.time_rules.at(15, 59),

self.buy_spy

)

# ACADEMIC VERSION: Sell at Monday market close (3:59 PM ET, just before close)

self.schedule.on(

self.date_rules.every(DayOfWeek.MONDAY),

self.time_rules.at(15, 59),

self.sell_spy

)

# Schedule end-of-backtest liquidation

self.schedule.on(self.date_rules.on(self.end_date.year, self.end_date.month, self.end_date.day),

self.time_rules.at(15, 0), self.place_moc_liquidation)

self.debug("HoldTheWeekendV2 (Academic Version) initialized")

def place_moc_liquidation(self):

"""Liquidate positions at end of backtest"""

if self.portfolio[self.spy].invested:

quantity = self.portfolio[self.spy].quantity

self.market_on_close_order(self.spy, -quantity)

self.log(f"MOC liquidation order: {quantity} shares")

def buy_spy(self):

"""Buy SPY at Friday market close (Academic Version)"""

if not self.portfolio[self.spy].invested:

self.set_holdings(self.spy, 1.0) # Invest 100%

self.log(f"Bought SPY at Friday close: {self.time}")

def sell_spy(self):

"""Sell SPY at Monday market close (Academic Version)"""

if self.portfolio[self.spy].invested:

self.liquidate(self.spy)

self.log(f"Sold SPY at Monday close: {self.time}")

def on_data(self, data: Slice):

pass

Research Sources:

- Federal Reserve Bank of Boston working papers on weekend effects

- ResearchGate: "Is the Weekend Effect Exploitable?"

- Arizona State University research on weekend effect myths

- Multiple peer-reviewed papers on market anomalies and trading strategy profitability

Educational Disclaimer: Everything on Backtest Arena is for educational purposes only. I'm not your financial advisor, and this isn't investment advice. I'm here to show you what doesn't work in trading, not to tell you what to buy or sell. All backtest results use historical data - markets change, and past performance means nothing for future results. Trading is risky and most people lose money. Do your own research and consult a qualified professional before risking real capital.