QQQ's 18% Trap: The Hidden Concentration Bomb

I just ran backtests comparing strategies against QQQ versus SPY. The results should terrify you.

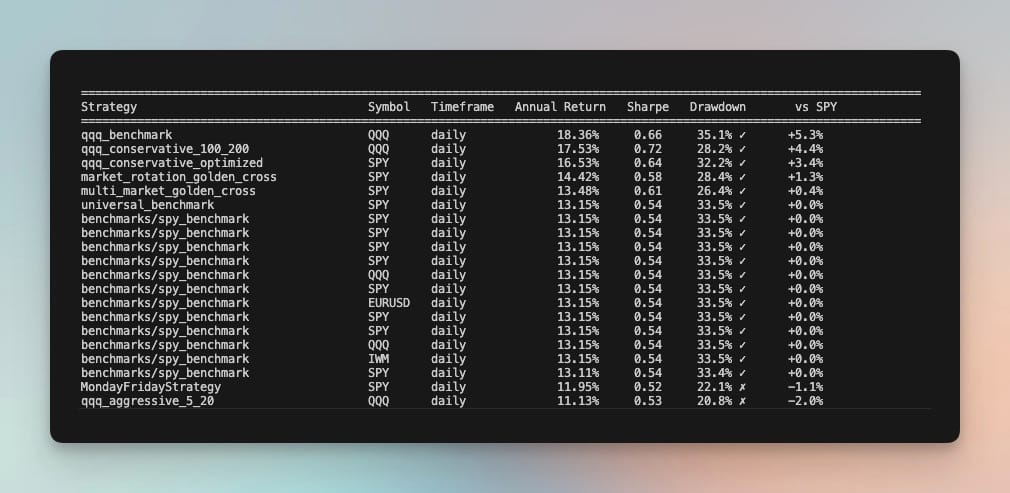

QQQ delivered 18.36% annually while SPY crawled along at 13.15% as we already went through. Every trader I know is switching benchmarks, chasing that extra 5%. They think they've found free alpha. They're wrong. They've found a trap.

Here's why using QQQ as your benchmark might be the most dangerous decision you make this decade. When your benchmark is up 18% annually, a coin flip becomes a trading genius. A broken clock beats the market twice a day. This isn't skill. It's surfing a tsunami and thinking you're a great swimmer.

The QQQ Composition Problem

Let's peek under the hood of QQQ. The top 6 holdings represent 40.33% of the fund as of July 2025: NVIDIA (9.85%), Microsoft (8.87%), Apple (7.32%), Amazon (5.54%), Broadcom (5.20%), and Meta (3.55%).

This creates significant concentration risk, far exceeding SPY's top 6 at just 28%. What they're selling as "tech diversification" is actually a leveraged bet on AI and cloud monopolies.

When you benchmark against QQQ, you're essentially asking: "Am I beating a basket of six companies trading at 30-50x earnings?" That's not diversification with extra steps. That's concentration with marketing.

Historical Reality Check

March 2000 called. It wants its overconfidence back.

The last time QQQ was the "obvious" benchmark: In 1999, QQQ soared 85% while SPY managed only 21%. Everyone switched to QQQ benchmarks. Then 2000 hit. QQQ collapsed 78% peak to trough and took 15 years to break even. SPY recovered in just 6 years.

The similarities are uncanny: AI hype replacing internet hype, mega-cap concentration, "this time is different" mentality.

History doesn't repeat, but it sure loves a good remix.

The Strategy Paradox: When Smart Money Gets Stupid

Here's what my backtests revealed about QQQ strategies: QQQ Conservative (100/200 MA) delivered 17.53%, underperforming buy and hold. QQQ Aggressive (5/20 MA) managed only 11.13%, significantly UNDERPERFORMING passive holding. QQQ Buy & Hold at 18.36% beat everything.

The punchline? In a momentum driven market, even conservative timing strategies struggle to add value. The Conservative strategy came close but still lagged by 0.8%. The Aggressive strategy failed spectacularly, giving up 7% annually to market timing.

This suggests something important: When your benchmark is in a sustained uptrend, frequent trading often destroys returns through whipsaws and missed moves.

When Benchmarks Become Weapons

Here's the psychological trap that QQQ benchmarking creates.

Risk management dies because a 30% drawdown looks "normal" when your benchmark swings 40%.

Strategies optimize for momentum, not sustainability: why hedge when up only works?

"Nobody gets fired for matching QQQ" becomes the new mantra, until everyone gets fired simultaneously.

Due diligence disappears because why analyze fundamentals when momentum pays the bills?

Survivorship bias multiplies as failed strategies look like timing issues rather than flawed logic.

Your benchmark isn't just a measuring stick. It's the lens through which you judge every decision, and right now, that lens is cracked.

The Uncomfortable Questions

Before you celebrate beating SPY with QQQ, ask yourself:

- If passive QQQ beats all your strategies, are you trading or gambling?

- What's your strategy when QQQ stops going up?

- Can you survive your benchmark dropping 50%?

- Is your "edge" just beta exposure to big tech?

If you can't answer these, you're not investing. You're hoping.

What This Means for Benchmarking

The QQQ benchmarking trend reveals several uncomfortable truths about how we evaluate trading strategies. SPY has survived multiple market cycles while QQQ's current performance reflects a specific tech boom period. Absolute returns can be misleading when they come from riding a sector bubble rather than genuine strategy skill. Bull market performance tells you nothing about strategy robustness since anyone can make money when everything goes up. The 2001 stress test question exposes whether you have a real strategy or just favorable market timing.

The uncomfortable reality: Robust strategies prove themselves across different market regimes. Bubble riding strategies only work when the bubble keeps inflating.

But here's the uncomfortable question I must ask myself: Am I being hypocritical by defaulting to SPY? Even SPY has its own concentration issues. Its top 10 holdings represent about 32% of the fund, and it's still heavily weighted toward the same mega cap tech companies dominating QQQ. The difference is degree, not kind.

Perhaps the real benchmark should be even broader: total stock market indices that include small and mid cap companies, or international diversification that doesn't assume American exceptionalism will continue forever. SPY is still a bet on large cap American companies in a specific historical period. It's just a less concentrated version of the same wager.

The Real Lesson: Gifts and Bills

My database shows QQQ crushing everything. Every metric screams "switch your benchmark now!" That's not evidence of QQQ's superiority. It's evidence that we're in dangerous territory. The market is offering you 18% returns for doing nothing. When has the market ever been this generous without sending a bill later?

The uncomfortable truth: The best traders make money in all market regimes. The lucky ones only make money when their benchmark is a rocket ship heading to the moon.

The question that matters: When QQQ inevitably comes back to earth, will your strategies survive the landing?

Or will you discover that you weren't trading at all: you were just along for the ride?

Author's Note

Those data inconsistencies you might have noticed in my results? Where SPY shows up with wrong symbols? That's real testing. I'd rather show you messy truth than polished lies. I test everything and hide nothing. Even my mistakes teach lessons.

Risk Disclaimer

Educational Disclaimer: Everything on Backtest Arena is for educational purposes only. I'm not your financial advisor, and this isn't investment advice. I'm here to show you what doesn't work in trading, not to tell you what to buy or sell. All backtest results use historical data - markets change, and past performance means nothing for future results. Trading is risky and most people lose money. Do your own research and consult a qualified professional before risking real capital.

Premium section: Backtest code

In this section you get the full source code that I used for all the backtesting strategies:

- qqq_benchmark

- qqq_conservative_100_200

- qqq_conservative_optimized

- qqq_aggressive_5_20

- qqq_fibonacci_21_50

Enjoy!